“What Would I Do If I Lost It All?” – FREE SUMMIT

(Disclosure: Many of the links on this page contain affiliate links. I have purchased and used or continue to use all of these products and recommend them to my clients. I will receive a small compensation when you purchase through the links, however you will not pay extra and, in some cases, may receive special bonuses. If you prefer not to use those links for purchasing, you may find many of them online by simply “googling” their names.)

What Would I Do If I Lost It All?

These are scary times!

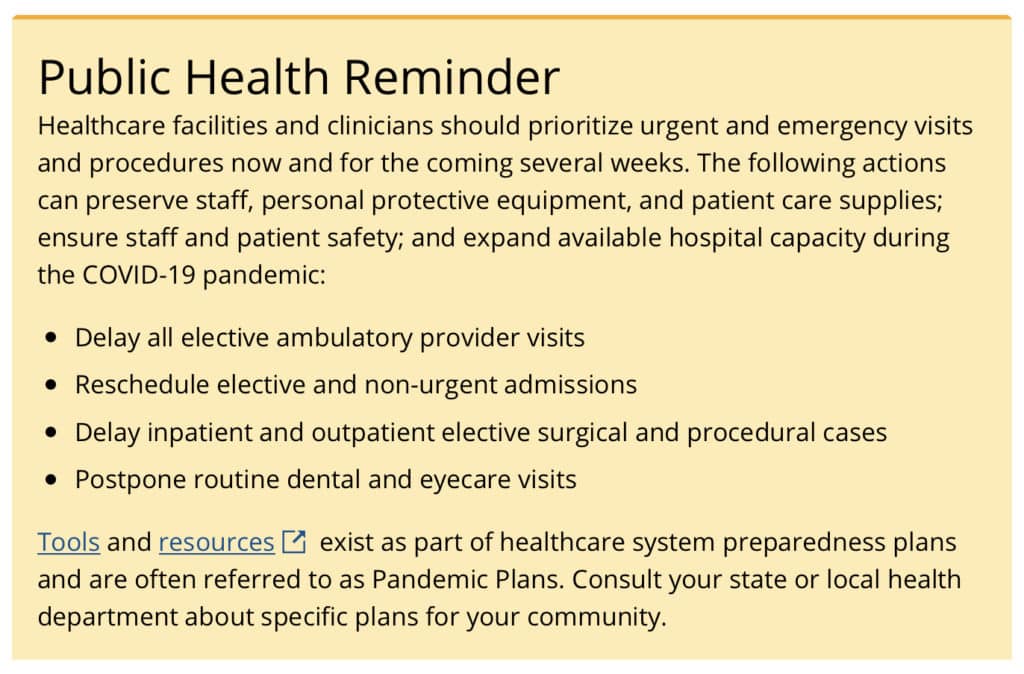

Never did I believe that I’d have to consider this question when starting my career as an optometrist almost thirty years ago. Nor did the tens of thousands of optometrists in the US who have been informed by the CDC (see image below) and other authorities that routine eye care must come to a halt in mid-march 2020.

For most of us, that means almost 100% of our income has come to an immediate standstill. Not only does the income disappear, but the practice expenses continue on, with some vendors adamantly expecting to be paid on time (don’t EVEN get me started on this!).

Of course, as the owners of the practices, we’ll be the first to sacrifice getting paid, thus putting our personal financial situations in jeopardy.

The toughest part of all…

We have no idea when it will end, when we can return to “normal” (whatever that is going to look like), and if we’ll even have patients booking appointments since their financial priorities are most likely going to shift.

What Are Our Options?

- A government bailout/stimulus package: yes, this has happened, but it will benefit each of us in different ways depending on our gross incomes, practice situations, employment status, and more. In addition, the amount of time it will take to receive the benefit may add undue burden to the financial situation.

- Reduce office expenses: including staff layoffs/furloughs/pay cuts, cost of goods sold, marketing, discretionary spending, etc.

- Borrow money: in the form of a home equity or commercial line of credit, personal loans, and/or credit cards (though I highly recommend avoiding incurring credit card debt, unless you have an influx of 0%, 18 month offers).

- Reduce home expenses

- Trade-in a car: trade-in or sell a car – get a lower monthly car payment/lease payment to reduce monthly expenses and relieve some of the burdens.

- Remortgage the home: reduce monthly payments by getting a lower interest rate.

- Reduce other discretionary expenses: do we really need all of those streaming services? Cable?

- Find ways we can still generate practice income

- See patients for emergency and urgent care: since the CDC has recommended that we CAN continue to see patients for emergency and urgent care, it makes sense that we should continue to be available for them under these circumstances. Since they are medical procedures, we may continue to provide the highest level of care and bill accordingly.

- Provide telemedecine/telehealth services: as allowed by our state boards, we may want to provide this service, if we haven’t already begun to – this will become a reality in our lifetimes. If we don’t provide this service, someone else will!

- Fill contact lens prescriptions: we can continue to fulfill contact lens prescriptions and mail them directly to our patients.

Have You Thought About This?

A Completely Separate Source of Income!

Phew! Thanks for hanging in there and sticking around to see what this post is really about!

For those of you that know me, you know that I’ve been in the online marketing and sales world for the past 10 to 15 years. I’ve learned a lot about making money from information products, affiliate products, eCommerce, freelance work, consulting/coaching, and more.

For the past few years, it’s become obvious who the REAL online money-making rockstars are, and who the “flash-in-the-pans” are — you know the type, those standing in front of a Lamborghini or private jet, implying they own them when, in reality, they rented them for a day for the photoshoot – it’s a thing!

To save you time deciding who’s real and who won’t hesitate to take your money and provide little to no value, one of my all-time favorite entrepreneurs is the guy you see in the image above, Russell Brunson.

Although he may not look old enough, he’s been helping online entrepreneurs realize their dreams for several years through his courses, books (DotCom Secrets, Expert Secrets, and soon-to-be-released Traffic Secrets), automated marketing funnel software (ClickFunnels™), and live events.

I went through Russell’s “30 Days Summit,” bought the $100 up-sell, One Funnel Away Challenge (see image below), and was completely blown away! I’ve spent $1,000’s on courses, marketing products, and books and this is, by far, the best one I’ve ever taken.

Here’s what Russell did to create the summit:

While You’re at Home

Here’s an idea – instead of binge-watching Netflix or cleaning out yet another closet during this down time, why not spend a portion of the next 30 days learning how to start a side business that could possibly blossom into another major income stream for you?

I’ve gone through it, am working on yet another profitable business project because of it (no, I haven’t been able to buy a Lamborghini!), and have never spent time or money investing in myself more wisely than with this summit and the One Funnel Away Challenge.

Here’s what you’ll get – You’ll be taken through a series of 30-day action plans that these millionaire mentors have actually accomplished or would initiate if they had to start over. They are all unique, provide priceless advice, and will spark ideas that will jump start your side business ideas.

As one of my wise mentors once said to me… “why not?”

Grab a pen, notepad, and enjoy the show… Start NOW by hitting the button below:

Yes! I Want to Join the FREE Summit TODAY!

Leave a Reply